Within the persuasive compliance programs, the Deep Surveillance is one of the most profitable programs for the SAT and the SHCP, since as its name suggests, this can trigger a comprehensive review of movements, operations and accounting records of a taxpayer.

Let’s go back a bit and stop to analyze a bit the deep surveillance carried out by the SAT.

Back in 2015 the SAT, began to deliver a series of invitations through various means to taxpayers who allegedly detected irregularities, in a campaign to prevent tax evasion and increase revenue.

The taxpayer was in the need to voluntarily satisfy the request for information that would discredit the assumption of such irregularities.

However, the persuasion factor varied depending on the region in which the program was applied, or other factors on the part of the SAT.

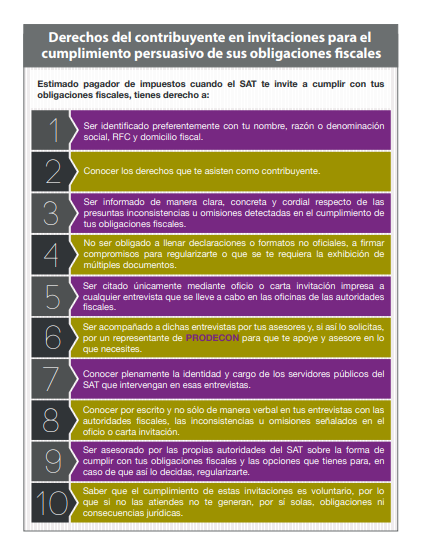

To the extent that, the Procurator in Defense of the Taxpayer (PRODECON), responded with a letter setting the bases of the rights of taxpayers with respect to said program.

Of which we can highlight some of the most important,

-

- To be informed in a clear, concrete and cordial manner of the alleged inconsistencies or omissions detected in compliance with tax obligations

- To be accompanied to these interviews by advisors who support and advise the taxpayer.

- Know in writing (not only verbally) in the interviews with the tax authorities, the inconsistencies or omissions indicated in the official letter or invitation letter.

- Know that the fulfillment of these invitations is voluntary, so if they are not attended they do not generate, by themselves, obligations or legal consequences.

Therefore, the Deep Surveillance , should be considered as such, a persuasive compliance program, which although it can be seen as a symptom of alleged inconsistencies, is a voluntary invitation to clarify them.

In DECXA we believe that a healthy accounting is a shared responsibility between the taxpayer and his accounting team, where he has the ability to identify, correct, prevent and clarify possible fiscal inconsistencies, giving peace of mind to comply with the provisions of the law .

Therefore, if you receive this invitation from the SAT, we suggest consulting with your accounting team and together take the course of action that best applies to your case. In the same way, we are at your service if you require accounting- fiscal advice services.