Today we will talk about the proposal of the Ministry of Finance for the creation of a new tax regime, the Simplified Trust Regime for 2022.

Let us remember that in 2014, to increase the taxpayer registry, the fiscal policy migrated to the population from the defunct Small Taxpayers Regime (REPECO), to the RIF (Incorporation Regime) with economic stimuli, which are close to expire.

Now, the proposal for a new simplification of examination, aims (as in the previous cases), to increase the register of taxpayers seeking to include the entire economically active population, at the same time that it simplifies the collection of taxes, through a balance between the reduction of the ISR and the elimination of the deductions and incentives offered in the RIF.

Let’s detail what this refers to.

Description

According to the draft of the Fiscal Miscellaneous resolution for fiscal year 2022, it is proposed to create a new regime, designed mainly for individuals who obtain income from business activities, fees or leases, less than $ 3,500,000.00.

In this, the elimination of the Tax Incorporation Regime (RIF) is considered because taxpayers will be able to change to the new Simplified Trust Regime, it also intends to adhere to around 10 million new taxpayers, seeking the objective of increasing the tax by 30 percent. number of contributors.

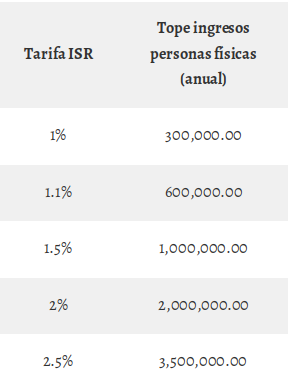

The ISR rates that he proposes are from 1% to 2.5% depending on the income:

In the case of natural persons, it will be available to those who belong to the,

- Regime of Natural Person with business activity

- Tax Incorporation Regime (RIF)

- Regime of agricultural, fishing, livestock and forestry activities

- Leasing Regime.

As long as they have income below 3.5 million pesos per year.

Advantages

Designed for individuals with a lower level of income, particularly taxpayers who currently pay taxes in business activity regimes; RIF; lease.

- Comply with tax obligations in an agile and simple way, aims that the taxpayer can find the preloaded information to generate the capture lines.

- Ease of issuing and requesting invoices through the SAT portal.

- They will be able to participate in the auctions carried out by the SAT in accordance with the general rules issued for this purpose.

- Failure to submit informative returns.

- They will not be obliged to keep electronic accounts.

- The invoices they issue may participate in the raffles determined by the SAT (such as “El Buen Fin”).

Disadvantages

- The determination of the calculation will be made based on the online digital tax receipts (CFDI) issued.

- Taxpayers who sign up for the trust regime will not be able to reduce the tax with deductions due to the low ISR rates.

- The VAT determination will be without tax incentives, that is, subtracting the creditable VAT from the transferred VAT.

- Payments will be calculated and paid on a monthly basis, no later than the 17th of the month immediately following the corresponding one.

- Presentation of the annual return in the month of April applying a table that fluctuates between 1% for cash income up to $ 300,000 and 2.5% for income up to $ 3,500,000, they may reduce the tax that the legal entities have withheld from them of 1.25% or paid in the monthly statements.

Moral people

In the case of companies or legal entities, the benefits raised by RESICO are the following:

- Payments in cash flow scheme, the income from the invoices issued and effectively paid would be accumulated, less the expenses actually incurred. In other words, the company would pay for what it actually charges, not for what it bills.

- Depreciation of investments at higher percentages than in the general regime.

The Simplified Trust Regime proposal, like any other, will hardly be able to please the existing fiscal dynamics of taxpayers and their operations in the past decade, however, if the SAT consolidates, it expects that a very high percentage of the national industry and services, they could opt for the new regime.

In general terms, we consider that this regime proposal does not foresee a significant reduction of the tax burden for taxpayers, however it intends to make it more transparent and easier to identify the regulations and guidelines that prevent tax evasion.

While the authority defines and publishes the parameters of the reform proposal, on the Despacho Contable de Xalapa we invite you to approach with your accountant and / or accounting team, to determine what strategy and tax regime will suit the future of your economic activity .

Remaining at your service to meet your accounting-tax needs and requirements.