We have previously commented on the Federal Law for the Prevention and Identification of Operations with Resources of Illicit Origin (LFPIORPI), known as “anti money laundering” in terms of the use of cash and metals allowed, by law in commercial operations.

Today, we resume this, since the SAT is using the self-regulation resource, as a corrective measure.

Initially we will say that a vulnerable activity is an economic act with the possibility of receiving money from illegal sources and / or whose amounts exceed the amounts established in the Law, affecting those who carry them out.

These limits are called thresholds . There are two of them. The threshold of identification , which is presented by the simple realization of the activity and the threshold of notice for the operations that clients or users carry out for an amount greater than established in the Law.

The XVI vulnerable acts that the Anti-Money Laundering Law (LFPIORPI) states in Article 17, are:

I. Games with bets, contests or raffles

II. Credit cards, services, prepaid, electronic wallets, electronic or paper vouchers

III. Travelers checks, issuance and marketing.

IV. Grantors of loans or credits (not financial)

V. Construction and development services for the sale of real estate

VI. Jewelry, metals and precious stones

VII. Auctions, and purchase or sale of works of art

VIII. Marketing of new or used cars

IX. Vehicle armor.

X. Transfer and custody of securities

XI. Professional and independent services (accountants)

XII. Notaries and Public Brokers, officials with Public Faith

XIII. Receipt of Donations

XIV. Customs agents and agents

XV. Leasing of Real Estate

XVI. Exchange of virtual assets

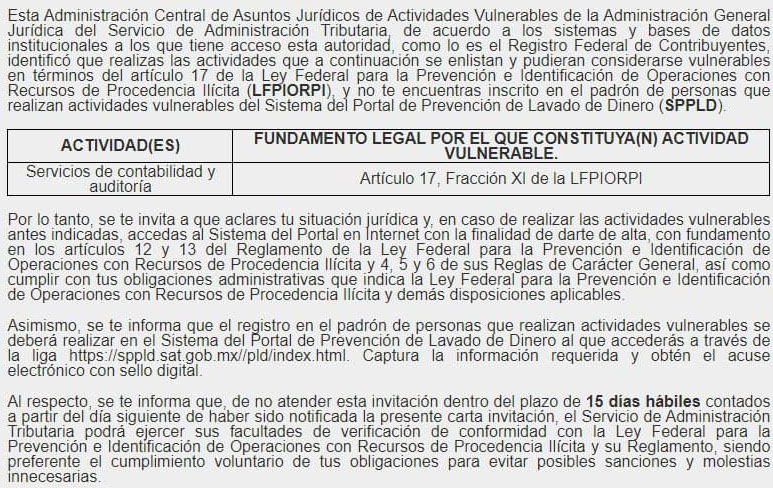

Reiterating the issue of self-regulation, we will address one of this list: the provision of professional services independently, particularly that offered by accountants.

Some doubts about it could be,

- Is it mandatory to do so?

- Are counters now considered as vulnerable activity ?

- Is it a tactic to make more taxes paid?

As with any important issue, the answer cannot be compacted in a yes or no, without the context required.

Is it mandatory to do so?

As most of the invitations of the Tax Administration Service are not mandatory as it is a self-regulation program. However, the incentives to do it voluntarily are lost by not acting within the period defined in the invitation since in the strict sense of interpretation, the possibility is presumed to refer to a possible case, of a sector omitted in previous years

Are accountants now considered vulnerable activity?

In general, no.

However this depends directly on the particular activities performed by the professional accountant or auditor. To define whether the invitation applies or not, we offer a brief overview to explain why,

XI . The provision of professional services, independently, without any employment relationship with the respective client, in those cases in which it is prepared for a client or carried out on behalf of the client and any of the following operations:

a) The sale of real estate or the transfer of rights over them;

b) The administration and management of resources, values or any other asset of its clients;

c) The management of bank accounts, savings or securities;

d) The organization of capital contributions or any other type of resources for the constitution, operation and administration of commercial companies, or

e) The constitution, spin-off, merger, operation and administration of legal entities or corporate vehicles, including trust and the purchase or sale of commercial entities.

All the operations indicated in the subsections of this section, will be subject to notice to the Secretariat when the provider of said services carries out, in the name and representation of a client, any of these, respecting the professional secrecy and the guarantee of defense in terms of this Law;

Fracción XI del Artículo 17 de la LFPIORPI

As stipulated in Article 17 in its Section XI, if any accountant, accounting or auditing firm performs some of the operations listed (normally owned by real estate sellers, capital investors, notaries among others) within the services provided, in that case if you consider a person with vulnerable activity .

Is it a tactic to make new taxes paid?

While this administration has mentioned the refusal to collect new taxes, it has also proclaimed to prevent and combat fraud and tax evasion. Therefore, the Secretaria de Hacienda y Crédito Público, through the Unit of Financial Intelligence (FIU) integrates and keeps updated the list of people who carry out vulnerable activities, with the ultimate goal of increasing tax collection.

In summary, the SAT invitations may or may not apply to your specific case, however you may consider them as an obligatory invitation to your accounting professional or auditor in case you cannot determine if you must register to fulfill additional obligations.

It is likely that this year we will again witness these practices of the SAT, in its fight against tax evasion, which is why we always recommend, keep calm and work hand in hand with your trusted team.