This national month we want to take the opportunity to expand the cultural heritage in Tax matters, for which we wish to speak about the Agricultural, Livestock, Fishing and Silvicultural Activities (AGAPES).

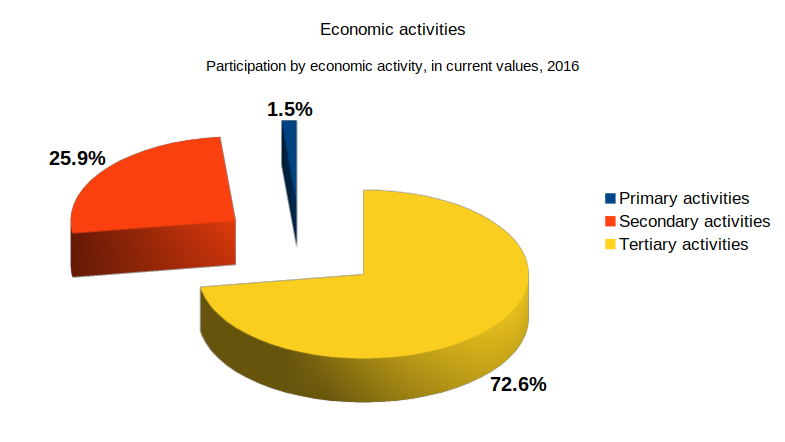

Let’s start with the basics, economic activities are divided into three sectors:

- Primary Sector: activities aimed at obtaining raw materials

- Secondary Sector: activities for the transformation of raw materials.

- Tertiary Sector: economic activities that provide services

According to article 16 of the Federal Tax Code, Business activities are

- Commercial

- Industrial

- Agricultural

- Livestock

- Fisheries

- Silvicultures

where the last four activities belong to the primary sector .

Definitions

Similarly, based on article 16 of the CFF, they are defined as follows:

I. Agricultural : They include those activities of sowing, cultivating, harvesting and the first disposal of the products obtained, which have not undergone industrial transformation.

II. Livestock : They are those consisting of the breeding and fattening of cattle, poultry and animals, as well as the first sale of their products, which have not been subject to industrial transformation.

III. Fisheries : They include the breeding, cultivation, promotion and care of the reproduction of all kinds of marine and freshwater species, including aquaculture, as well as the capture and extraction of the same and the first sale of those products, which have not undergone industrial transformation.

IV. Silviculturals : They are the cultivation of forests or mountains, as well as the breeding, conservation, restoration, promotion and use of their vegetation and the first alienation of its products, which have not undergone industrial transformation.

Considerations of the AGAPES Regime

You can belong to this regime, if you are a natural person who is dedicated exclusively to agricultural, livestock, forestry or fishing activities.

It is considered that it is exclusively dedicated to activities in the primary sector, when its income from said sector represents at least 90% of the total, the above, not including sales of land, machinery, or automobiles belonging to your fixed asset.

For the fulfillment of your obligations you can choose to pay your taxes independently or as a member of a legal entity.

In the same way, if you obtain income from agricultural, livestock, forestry or fishing activities and represent at least 25% of your total income in the year, you can pay taxes in this regime having the possibility of obtaining income from business activities other than the primary sector or even obtain another type of income; provided that in the year their total does not exceed 8 UMAs raised per year

Administrative Facilities

- It does not pay income tax (ISR) up to an annual amount, of 20 UMA’s raised per year, for each of its partners or associates.

- In your provisional returns you can apply a reduction of 30% in the income tax (ISR) determined.

- You can choose to file your provisional returns on a monthly or semi-annual basis.

- You can obtain your refund of balances in favor of VAT within a maximum period of 20 business days.

As you can see the activities of the AGAPES Tax Regime, has a very broad field in the use of natural resources, as well as options to be subject to tax legislation.

At the Despacho Contable de Xalapa, we will help you to regularize, structure and project your tax situation within this broad area so that the tax issue is one less task to worry about.