Almost 3 months after the CFDI 4.0 format came into force, we know that there are doubts regarding the compatibility of tax regimes and how they are used now.

To ensure clarity, we want to expand the information in our latest publication related to the use of CFDI.

As we have mentioned previously, there are various tax regimes for individuals, among them we can mention,

- Simplified Trust Regime

- Wages and salaries and income assimilated to salaries

- Regime of Business and Professional Activities

- Fiscal Incorporation Regime

- Alienation of assets

- Regime of Business Activities with income through Technological Platforms

- Lease Regime

- Interest income

- Others

These regimes must be seen as fiscal responsibilities, and not as a single profile; since these are “activated” or “deactivated” according to tax circumstances. In other words, if you move between different regimes, some will register or others may suspend activities because they are no longer part of your fiscal activity.

To illustrate: those who receive income from salaried work and at the same time carry out a private professional practice, or develop a business, must be registered in the two corresponding regimes, defining a higher percentage for the regime that generates the greatest amount of income.

It is important to note that, despite the fact that the Tax Incorporation Regime still exists operationally, it ceased to be in force as of December 31, 2022 and this regime will gradually cease to be used.

Due to the aforementioned, we share a list of compatible regimes between natural and legal persons for your information.

Tax Regime Catalog – CFDI Version 4.0

| Tax Regime | Description | Natural person | Legal Entity |

| 601 | General Law of Legal Entities | No | Yes |

| 603 | Legal Entities with Non-Profit Purposes | No | Yes |

| 605 | Wages and Salaries and Income Assimilated to Salaries | Yes | No |

| 606 | Lease | Yes | No |

| 607 | Alienation or Acquisition of Assets Regime | Yes | No |

| 608 | Other income | Yes | No |

| 610 | Residents Abroad without Permanent Establishment in Mexico | Yes | Yes |

| 611 | Dividend income (partners and shareholders) | Yes | No |

| 612 | Personas Físicas con Actividades Empresariales y Profesionales | Yes | No |

| 614 | Ingresos por intereses | Yes | No |

| 615 | Income regime by obtaining prizes | Yes | No |

| 616 | No tax obligations | Yes | No |

| 620 | Production Cooperative Societies that choose to defer their income | No | Yes |

| 621 | Fiscal Incorporation | Yes | No |

| 622 | Agricultural, Livestock, Forestry and Fishing Activities | No | Yes |

| 623 | Optional for Groups of Companies | No | YES |

| 624 | Coordinated | No | Yes |

| 625 | Régimen de las Actividades Empresariales con ingresos a través de Plataformas Tecnológicas | Yes | No |

| 626 | Simplified Trust Regime | Yes | Yes |

As you could see, there is a unique identity in the regimes of people and companies.

Consequently, the use of the CFDI has a direct relationship with the taxpayer’s regime. That is to say, depending on the legal personality, it is how the authority considers the use of ‘invoices’ in each one’s accounting.

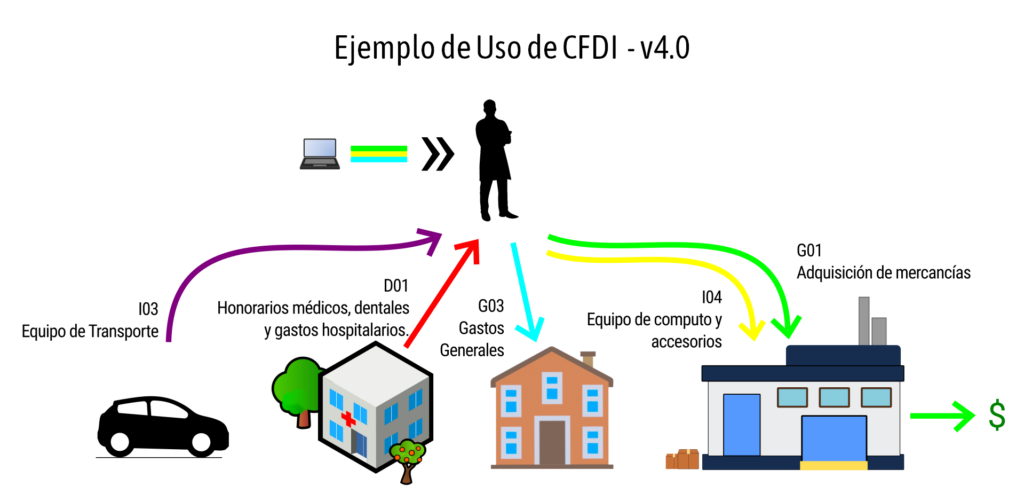

Use of CFDI v4.0

The money spent, justified in the vouchers (invoices), is directly and specifically related to the purpose pursued in the business and, at the same time, to the type of taxpayer regime.

As we have previously mentioned, depending on the use it will receive (the product or service) it can be considered,

- Spent

- Commodity

- Fixed assets, to mention a few examples:

- Computer equipment

- Transportation equipment

- etc.

- Among others.

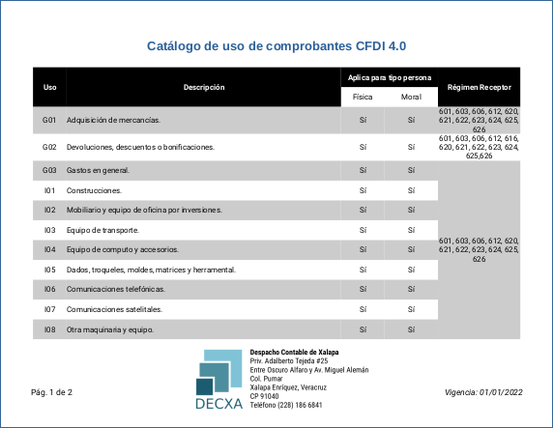

To avoid inconsistencies, we display for your knowledge, the catalog between the link of the Use of CFDI and the regime, updated for version CFDI 4.0

It should be noted that if, when requesting an invoice, the issuer indicates that it cannot be stamped, it is most likely due to the incompatibility between the Use of the CFDI and the Regime, therefore we suggest you consider this catalog to avoid complications or in the worst case, not receiving the ‘invoice’ for the economic resource.

With this information, we trust you will have a better idea of what corresponds to your vouchers and your fiscal activity in general. Remember that if you require professional accounting advice, you can count on the Despacho Contable de Xalapa to meet your tax requirements.