by Despacho Contable de Xalapa | Nov 10, 2023 | News

A recurring doubt among taxpayers that causes delays in procedures before the SAT; is the validity of the e-signature and the 8-digit password previously called CIECF. Therefore, we will talk about it, to remember what is stipulated in the CFF, RMF and complementary...

by Despacho Contable de Xalapa | Jun 21, 2023 | News

Almost 3 months after the CFDI 4.0 format came into force, we know that there are doubts regarding the compatibility of tax regimes and how they are used now. To ensure clarity, we want to expand the information in our latest publication related to the use of CFDI....

by Despacho Contable de Xalapa | Apr 19, 2023 | News

Just about a year before the 2021 tax return, we were commenting on the Retirees’ statement regarding the 2022 RMF. Declaración Anual para Jubilados: RMF 2022 In this we informed you that if you as a Retiree received more than 400 thousand pesos per year, you...

by Despacho Contable de Xalapa | Feb 28, 2023 | News

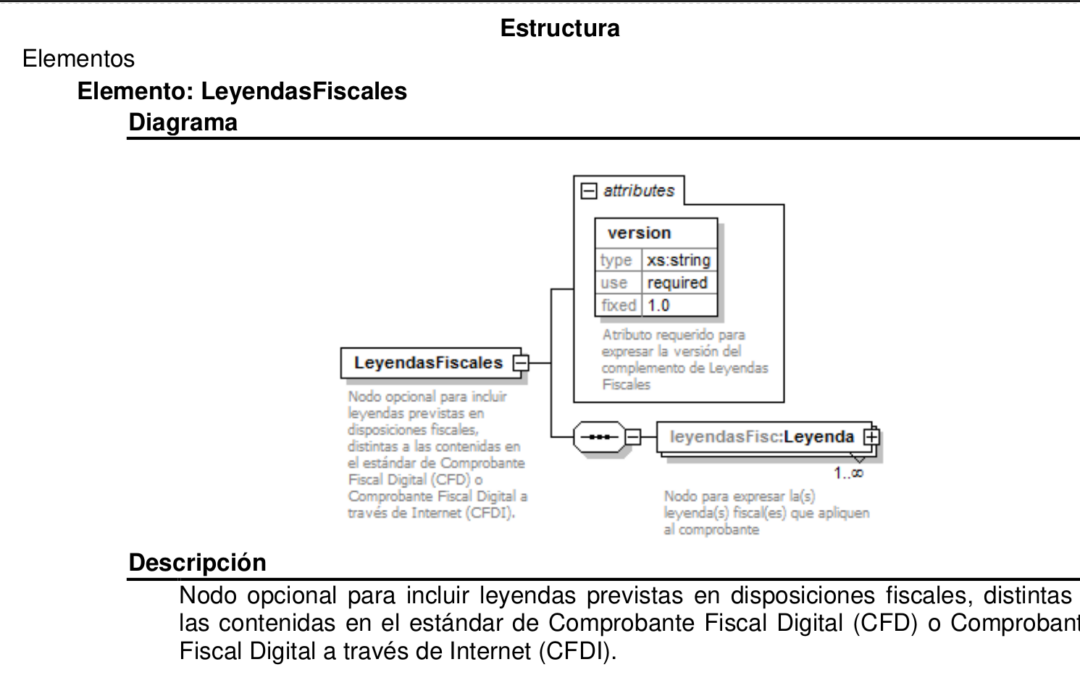

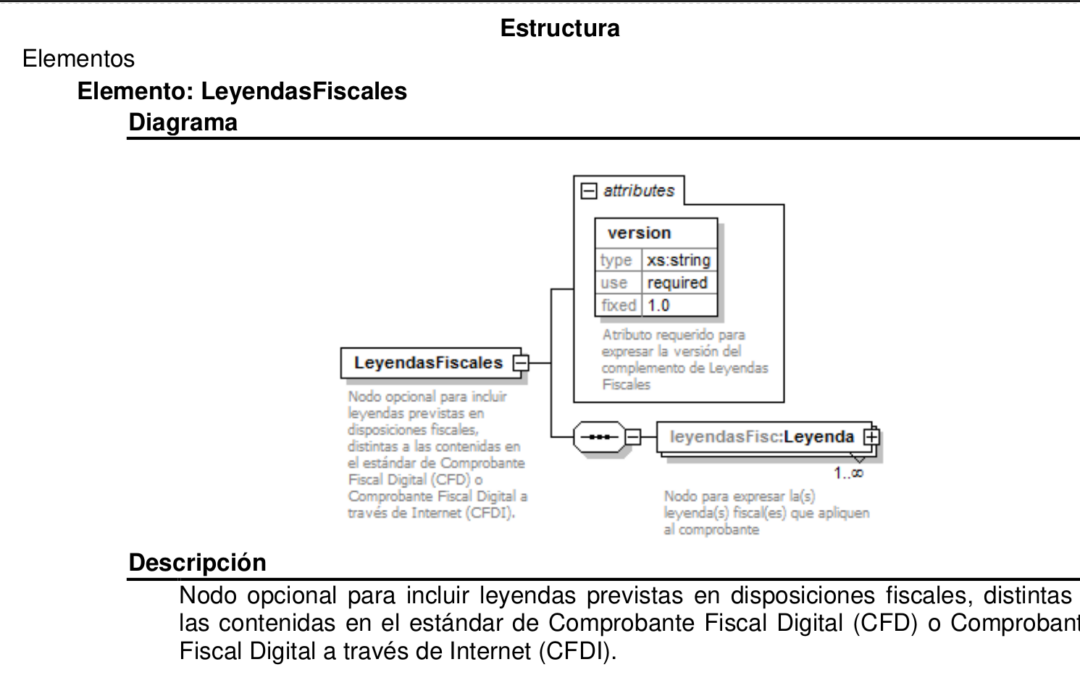

Almost at the end of the last extension (March 31, 2023) for the migration to CFDI 4.0, due to the above, the need to know more about the new fields of the voucher in version 4.0 becomes evident. In this brief entry we will talk about the Tax Legends, an optional node...

by Despacho Contable de Xalapa | Dec 23, 2022 | News

This 2022, like the last ones, has been a year full of changes, challenges and goals achieved. Every year at the Despacho Contable de Xalapa we strive to maintain continuous improvement and this year was no exception due to the changes that will come into effect this...

by Despacho Contable de Xalapa | Nov 9, 2022 | News

We are close to the end of 2022, and this brings an important change in billing in Mexico, since on January 1, 2023, the use of the CDFI v4.0 format comes into force mandatory The most important additions [to the data already used in v3.3] are: the postal code of the...

by Despacho Contable de Xalapa | Jun 14, 2022 | News

Habemus extension! On June 8, the SAT through an official statement (029/2022) reported the extension of the deadline for the mandatory implementation of the CDFI 4.0 format through an extension until January 1, 2023. Comunicado 029/2022 – SAT This news was made...

by Despacho Contable de Xalapa | Apr 14, 2022 | News

For the majority of the economically active population, the season to present the annual declaration has arrived: April. However, due to Miscellaneous Tax Resolution 2022, there are small changes related to retired workers that should be taken into account. Since, as...

by Despacho Contable de Xalapa | Feb 21, 2022 | News

With the first period of January, the entry into operation of RESICO and other legislation, we receive new news that will be of interest to those taxpayers who closely follow the changes in legislation, During the first week of February, the First Advance Version of...

by Despacho Contable de Xalapa | Oct 21, 2021 | News

Today we will talk about the proposal of the Ministry of Finance for the creation of a new tax regime, the Simplified Trust Regime for 2022. Let us remember that in 2014, to increase the taxpayer registry, the fiscal policy migrated to the population from the defunct...