It is well known that technology is generating a great impact in the determination of taxes. Whether we want it or not, the information traffic produces benefits for both users and the treasury.

With the beginning of the validity of version 3.3 of electronic invoice, it is mandatory that taxpayers specify the CFDI use on it. And, due to the great amount of doubts that this represents for the clients, it is that we gave ourselves to the task of writing this text, to favor the understanding of this new node.

A tax receipt justifies tax payment in the tax system and must be issued: for the acts or activities that are disposed of, for the income received or for withholdings of contributions made by taxpayers (individuals or corporations).

In this new field “Use CFDI” you must indicate the use that the receiver of the invoice will give you by means of a key that corresponds to the use of the tax receipt. For this, the SAT provided the following catalog to meet this requirement:

In this new field “Use CFDI” you must indicate the use that the receiver of the invoice will give you by means of a key that corresponds to the use of the tax receipt. For this, the SAT provided the following catalog to meet this requirement:

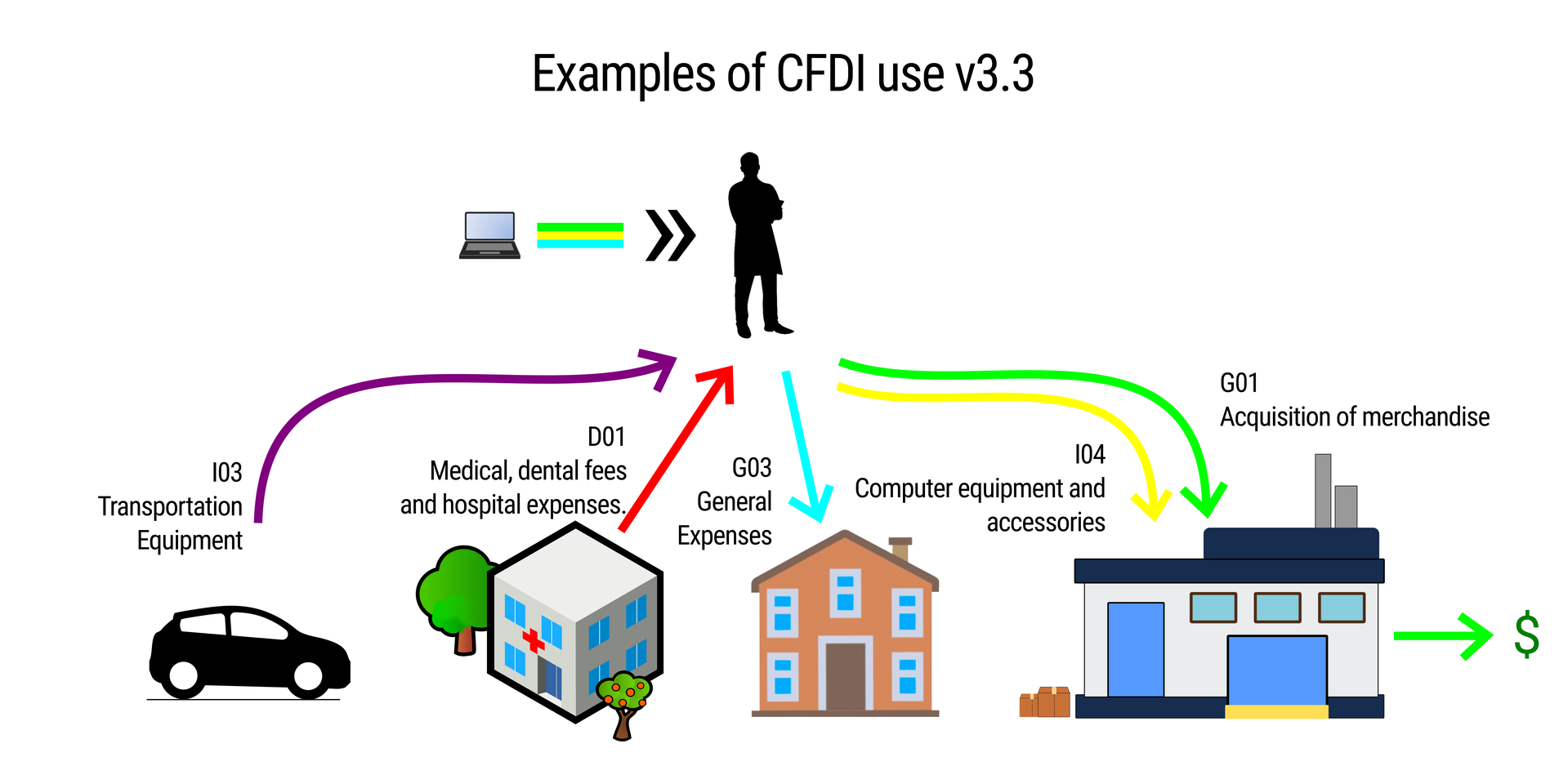

The taxpayer must know the differences between the CFDI use catalog accounts, so we present below 3 examples of the use of CFDI.

Example 1 : If a taxpayer acquires a computer and his money is selling computers his “Use of CFDI” will be: G01 Acquisition of merchandise, since the computers represent, his merchandise to sell; but if you buy the computer for your own use it represents a fixed asset and the use of CFDI will be: I04 Computer equipment and accessories .

Example 2 : If a taxpayer engaged in the sale of cleaning supplies makes a purchase of detergent, his use of CFDI would be G01 Acquisition of goods, but if another taxpayer makes a purchase of detergent and its turnover is To sell furniture your use of CFDI would be: G03 Expenses in general .

Example 3 : If a taxpayer purchases a van and will use it in the activity of his business, or even for personal use, the use of the CFDI will be: I03 Transportation Team .

Example 4 : In the event that a taxpayer carries out a clinical analysis on the same day, he buys a pair of glasses and a medical consultation, in all cases the use of the CFDI that must be mentioned to the issuer of the invoice will be: D01 Medical, dental and hospital expenses .

It is very important to know the keys of the types of use of the invoice since to fill this field with any requirement that does not comply with the established by the SAT, the CFDI can not be physically credited or deducted. So it is very important to pay close attention when placing the correct key for a person or entity. If you use it incorrectly, your invoice may have no value.

This field is mandatory to generate your CFDI and remember that in case the receiver is going to give you a use that is not in the previous keys, there will be no reason to cancel the invoice.

We invite you to download the complete catalog (on Spanish) updated at the time of writing this post for your information and convenience.

Excellent week start.