We are close to the end of 2022, and this brings an important change in billing in Mexico, since on January 1, 2023, the use of the CDFI v4.0 format comes into force mandatory

The most important additions [to the data already used in v3.3] are: the postal code of the address and the tax regime of the recipient; causing the Proof of Fiscal Situation to be the main document to register new billing recipients in version 4.0

The migration of the version represents the opportunity for a large number of taxpayers to verify the data registered in their Fiscal Situation Certificate, which has presented a frequent need to update the data, being the address and the regime, the main ones.

In order to help you in this process, in this post we will explain how to carry out this operation through the SAT portal.

Developing

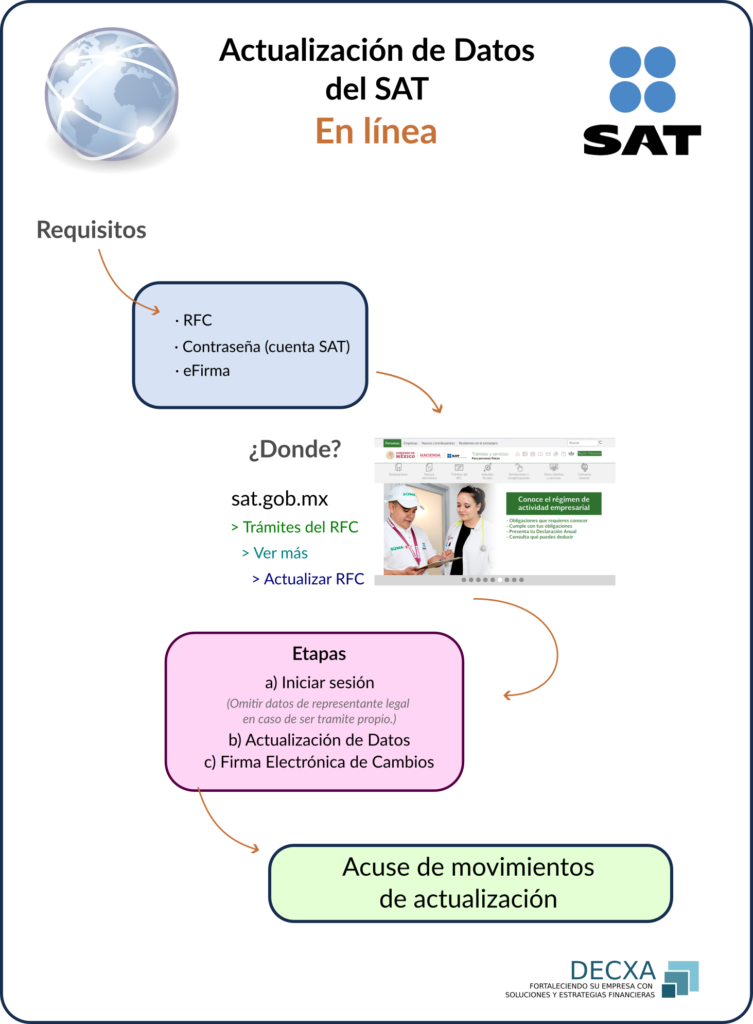

Below we detail this process online.

SAT website

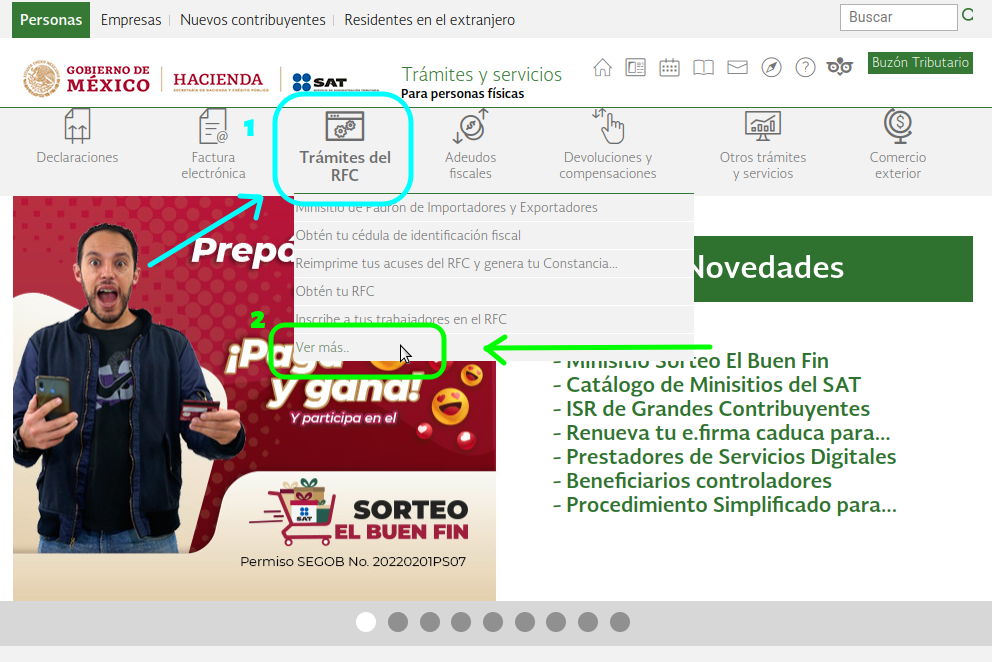

We access from the SAT portal,

Trámites del RFC » Ver más…

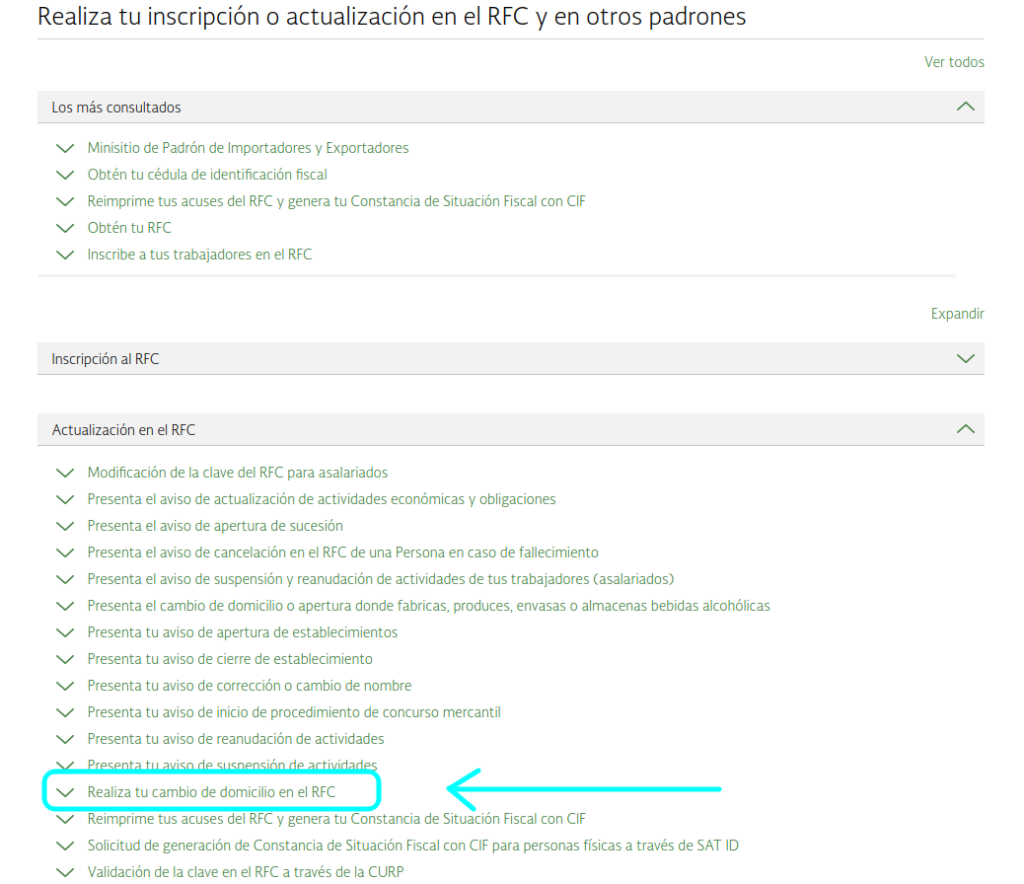

Later we scroll to the bottom and select,

Actualización del RFC » Realiza tu cambio de domicilio en el RFC

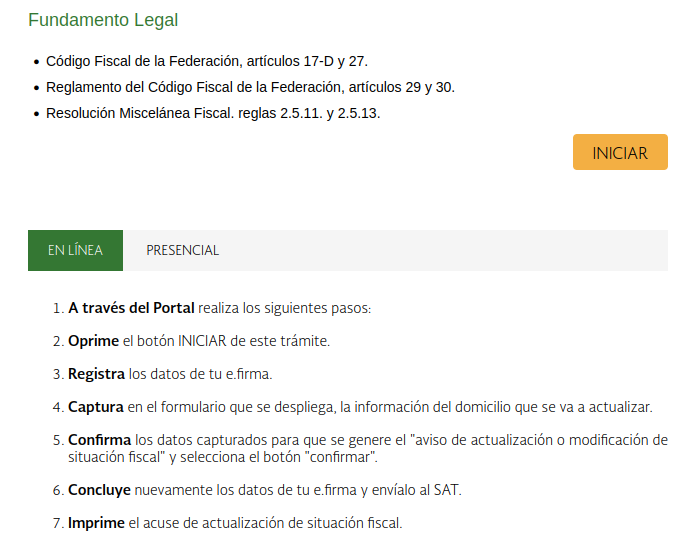

When accessing the operation we find a brief summary of the process, on that site you will find the “INICIAR” button, which is a direct link to the operation.

Identification and access

Once the process has started we will arrive at the identification and access section, for this we will use the ordinary password of your tax mailbox or the e.Signature,

Address update

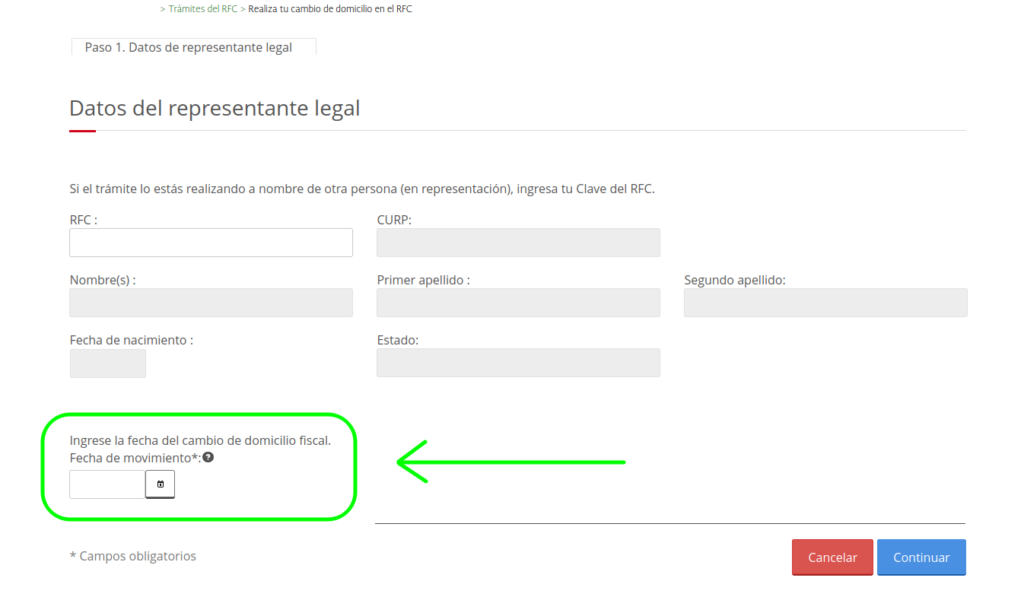

The process begins by requesting to identify who is making the change if the legal representative or a proxy, in the vast majority of cases it is the same taxpayer who performs the update, so it would not be necessary to fill in other fields other than placing the date at the bottom. and press “Continue”.

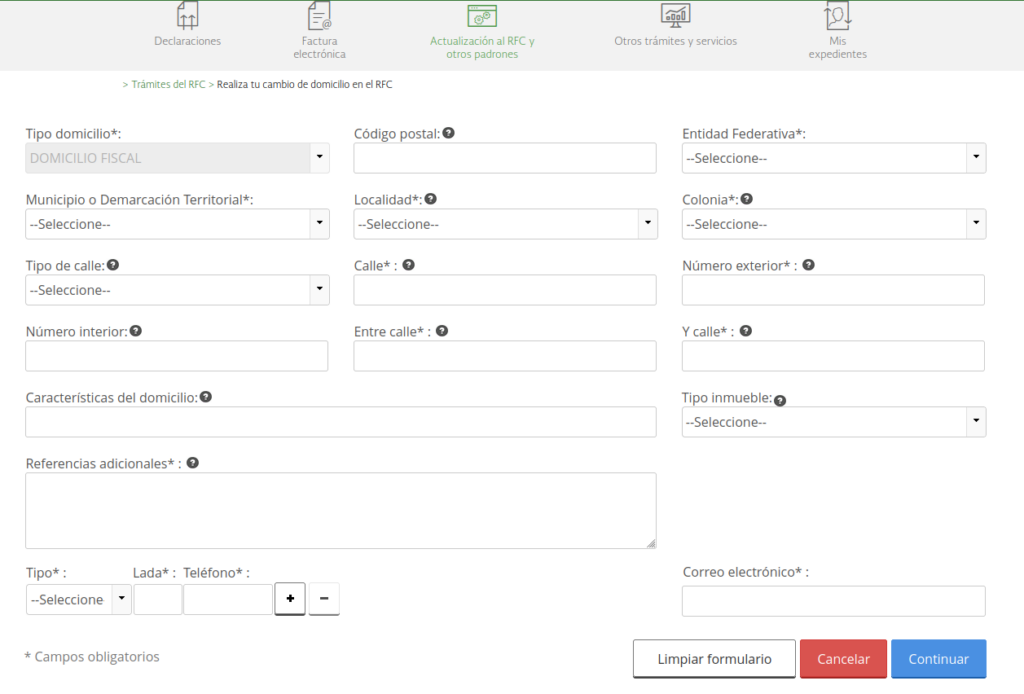

We continue with step 2, in which we make the changes to the fiscal domicile linked to the RFC.

Once the changes have been made, click on the “Continue” button.

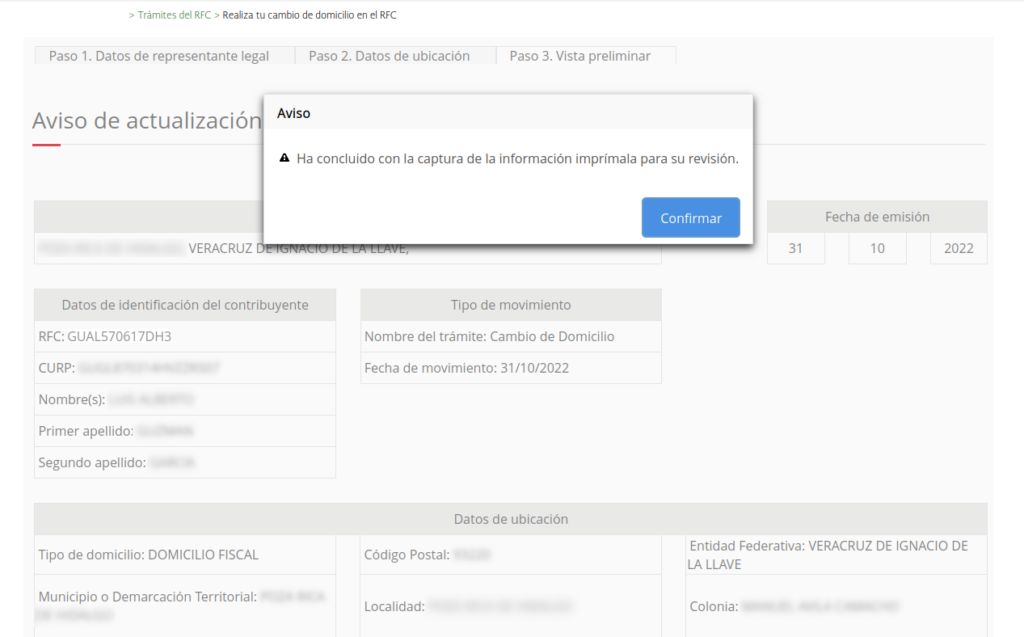

Once the data in the form has been updated, a preview is presented to confirm that there is no error in the update.

Once confirmed that everything is in order, click on “Confirmar“.

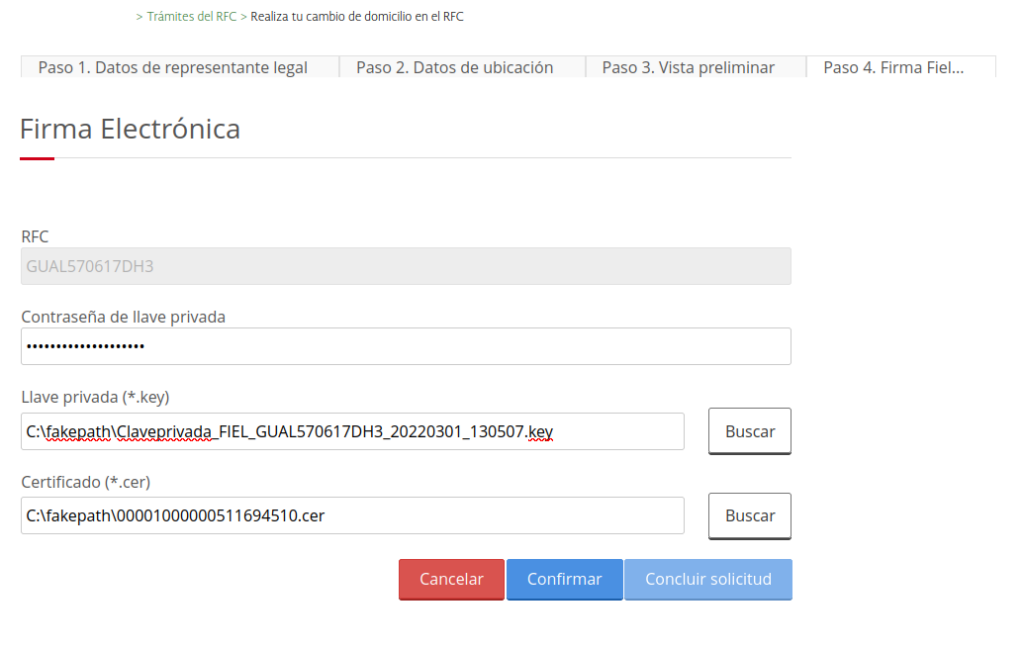

Like any change in official documentation, this change must be digitally signed to validate the authenticity of the data and who makes the change, for which we will upload our electronic signature (e.Firma) and confirm the process.

Once the process is completed, we will obtain the Acuse de Movimientos de actualización de Situación Fiscal, which is proof of the change made, which we suggest keeping.

It should be noted that the changes will be reflected when generating a new Constancia Situación Fiscal, so if your fiscal address had a change of postal code or could have inconsistencies, we suggest you update it.

Trusting that this tutorial has been useful, we can only endorse the level of professionalism that the Despacho Contable de Xalapa has for our clients, remaining at your disposal.