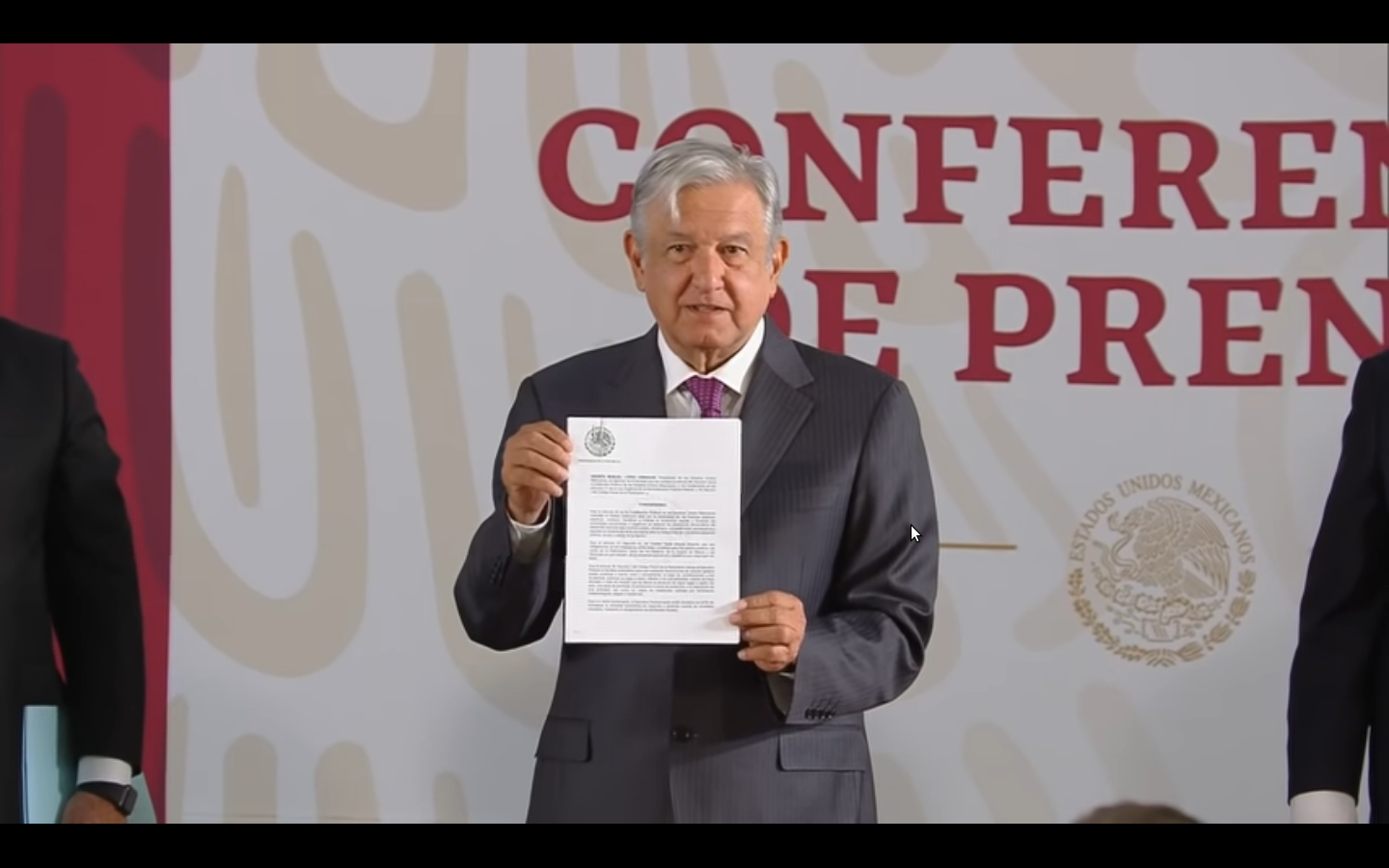

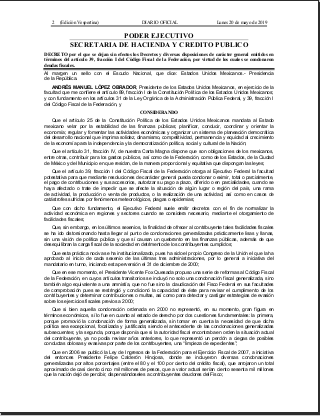

Last week, during the morning press conferences, the president signed a decree that ends with the forgiveness of taxes, a public policy that began in late 2000.

2000 – 2006 – Applying waivers of 10% to 12.5%

2007 – 2012 – Applying waivers of up to 80%

2012 – 2018 – Applying waivers between 60% and 100%

This is mainly because, as stated by the head of the SAT, Margarita Ríos Farjat, there was a strong flight of contributions, as well as the constitutional breach of responsibility with the tax obligations of all citizens, and not least to restrict the powers of the treasury in audit and transparency of accounts.

Said by President Andres Manuel Lopez Obrador,

“…en dos sexenios se condonaron a grandes contribuyentes alrededor de 400,000 millones de pesos […] es acabar con privilegios fiscales, es hacer valer la Constitución en la letra y en el espíritu, de que todos tenemos que contribuir y que tiene que haber una recaudación con el principio de progresividad…”.

President AMLO

With this change it is expected to increase the collection of taxes for the benefit of public finances as well as complying with the obligation of all citizens to contribute to public spending as mandated by the constitution.

As we have said before, we consider that a healthy accounting rests within a legal framework and supported by an economic development policy , so that the application of public policies allowed by law to benefit of the taxpayer, are an important part of the accounting work, taking care at all times the ethics of the taxpayer.

We hope that these changes will level the balance of fiscal responsibilities for all taxpayers regardless of their size, for the benefit of a fiscally responsible society.

Remember that in the Despacho Contable de Xalapa we are constantly updating to keep us at the forefront of tax changes in favor of our clients.