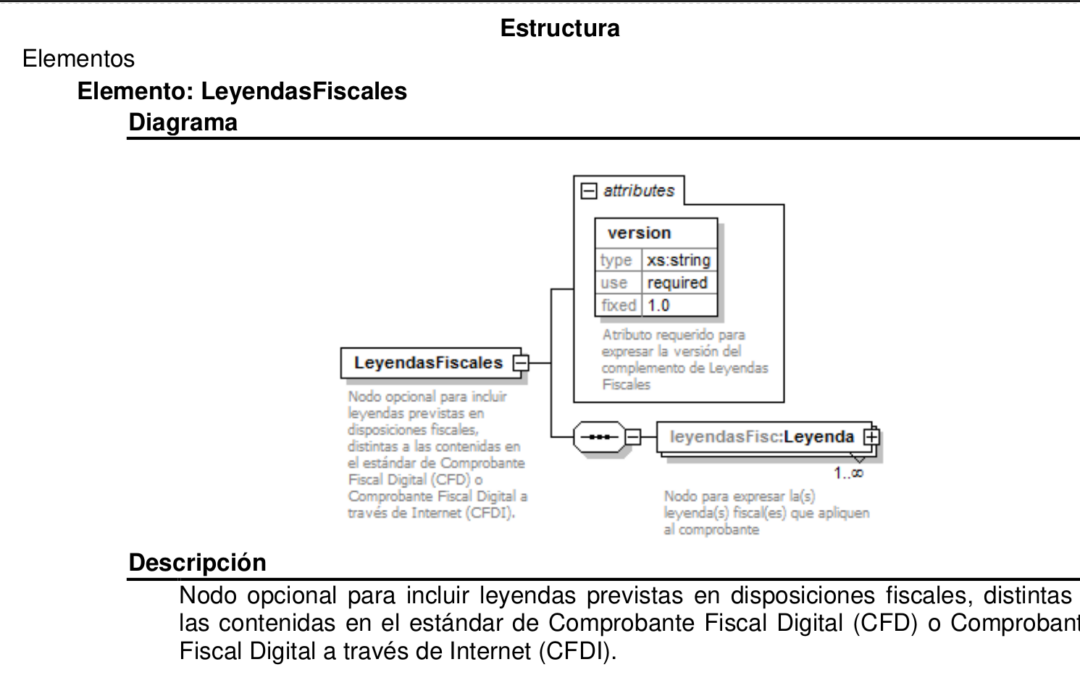

Almost at the end of the last extension (March 31, 2023) for the migration to CFDI 4.0, due to the above, the need to know more about the new fields of the voucher in version 4.0 becomes evident. In this brief entry we will talk about the Tax Legends, an optional node of additional information to the Tax Receipt, depending on what applies in each case.

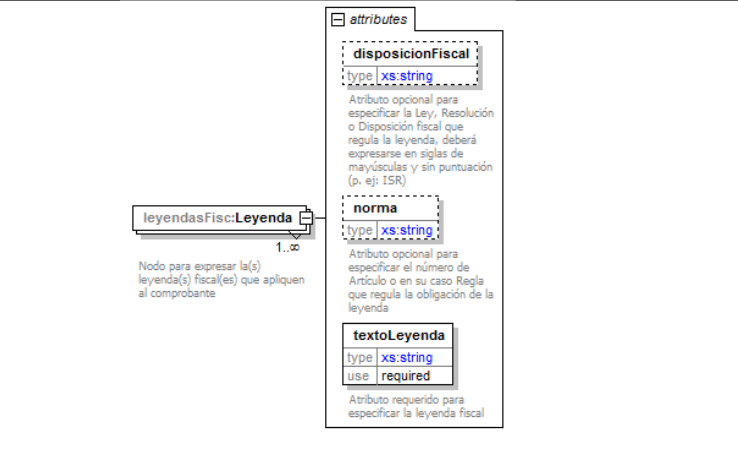

This element is made up of the following attributes:

Tax provision

Optional attribute: Section to specify the Law, Resolution or Fiscal Provision that regulates the Legend, expressed in capital letters and without punctuation (For example: CFF).

Norm

Optional attribute: Section where the article or rule number is mentioned, which regulates the legend. (For example: Article 29)

Legend text

Required attribute: Section to specify, the text that supports the tax provisions, other than those mentioned in the technical standard of the voucher, but which are also part of the tax provisions.

Finally, it is important to mention that the SAT has published some precise instructions regarding the Sequence of Elements to Integrate in the Original Chain:

- None of the attributes that make up the tax receipt must contain the character | (“pipe”) since this will be used as a control character in the formation of the original string.

- The original string resulting from the complement will be integrated into the original string of the voucher in accordance with the provisions of Annex 20 of the Miscellaneous Fiscal Resolution in force.

- The attribute it refers to will not be expressed. However, it will be expressed that they exist.

- The optional data, when it does not exist, will not appear expressed in the original string and will not have any delimiter.

We suggest that, in the use of CFDI 4.0, the use of these fields becomes a normal practice, for the operation of your billing.

This becomes even more relevant, the moment of requesting the cancellation and issuance of a corrective invoice, so that the operation has a specific legal basis, entering into compliance with the filling of the CFDI.

We invite you to relate to the new fields that the CFDI 4.0 format introduces in the billing of operations, so taking the time to analyze this new section will be useful if imports or exports are made between your operations. Since, as established in the Federal Tax Code (CFF), there are fines and sanctions related to the incorrect stamping of CFDIs, which will apply in version 4.0

Remember that you have the Despacho Contable de Xalapa to professionally meet your accounting requirements.

We remain at your service.