In accounting issues, constant updating is an investment that will always pay off.

In this regard, the Universal Compensation has undergone major changes by virtue of the approval of the Income Law of the Federation (LIF) in December 2018, for this reason, today we will give the most relevant details.

In summary terms

As of 2019,

You can only offset balances in favor of ISR, as well as IEPS against themselves.

- In the case of Income Tax, withholdings do not apply to third parties.

Outstanding balances for 2018,

- They will be able to compensate against each other (ISR, VAT, IEPS), without applying third party withholding.

- If you pay VAT at 0% you can only declare the month of January to compensate VAT against ISR.

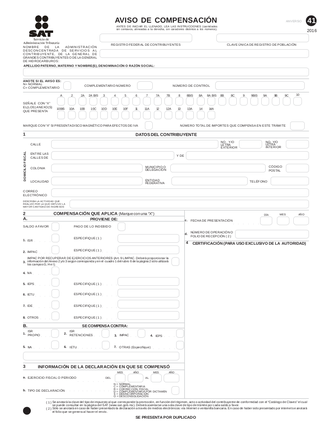

Compensation Notice

These changes, as we have commented above, have a direct implication in the flow of the tax burden of the main regimes of taxpayers except of those taxing in the Tax Incorporation Regime (RIF), at least during their stay in this regime (less than 10 years).

This brings us to the month of February 2019, where the application of these measures will begin with the presentation of the Compensation Notice for the month of January 2019.

What is the importance of this process?

The constant updating of national economic policies causes an abysmal difference in the flow of tax information, which requires expertise and commitment.

That is, the notice of compensation is presented through the format 41 accompanied by the documentation requested for that purpose in the official form (Rule 2.3.10 6a. RMF) and supported in the monthly accounts presented.

Implications

The authority expects that you, a distinguished taxpayer, present your accounting in accordance with the provisions of the law and, in full follow-up to the modifications and updates thereof, for this reason we believe it is advisable to know the scope of these changes.

According to Article 81, Fraction I and II of the CFF, the failure to submit notices as well as the incorrect, partial or incomplete presentation may result in fines as stipulated in Article 82 of the CFF.

I. No presentar las declaraciones, las solicitudes, los avisos o las constancias que exijan las disposiciones fiscales, o no hacerlo a través de los medios electrónicos que señale la Secretaría de Hacienda y Crédito Público o presentarlos a requerimiento de las autoridades fiscales. No cumplir los requerimientos de las autoridades fiscales para presentar alguno de los documentos o medios electrónicos a que se refiere esta fracción, o cumplirlos fuera de los plazos señalados en los mismos.

Artículo 81. Fracc. I del Código Fiscal de la Federación.

II. Presentar las declaraciones, las solicitudes, los avisos, o expedir constancias, incompletos, con errores o en forma distinta a lo señalado por las disposiciones fiscales, o bien cuando se presenten con dichas irregularidades, las declaraciones o los avisos en medios electrónicos.

Article 81. Fracc. II of the Fiscal Code of the Federation.

Lo anterior no será aplicable tratándose de la presentación de la solicitud de inscripción al Registro Federal de Contribuyentes

Recommendations

We suggest extensively that, if affected by these changes, study in detail the fiscal strategy that is up to your requirements in close company of your accounting team. Since February will be a milestone in the definition of the new fiscal model and the mechanisms applied in the Government of the Republic.

Avoid errors, delays and / or fines, which could lead to audits and with it, the increase of your accounting cost.

At Despacho Contable de Xalapa we understand the challenge that this implies for our clients, and we face these requirements through efficient communication and constant updating for the benefit of our clients.