With the creation of the Fiscal Incorporation Regime, RIF in Spanish, the “small” taxpayers have been included in the national financial activity under a simple framework and with multiple tax benefits for them.

However, it has 3 fundamental limitations,

- 10 years of duration

- A maximum of 2 million Mexican pesos in revenue during the fiscal year

- Comply with the obligation to submit bi-monthly statements or, failing that, resolve the requirements of the authority as soon as possible.

By neglecting any of the 3, the taxpayer automatically converts to the Business and Professional Activity Regime, RAEP in Spanish.

We received a lot of comments asking about this transition, so we wanted to offer a little more details of rule 3.13.9 of the Miscellaneous Fiscal Resolution.

Let’s start knowing the most notable requirements of the Business and Professional Activity Regime before the SAT,

- Keep your information updated before the RFC.

- Issue corresponding electronic invoices.

- Keep accounting.

- Submit 12 Monthly Statements, an Annual Declaration and 12 Informative Statements.

- Formulate statement of financial position and inventory inventory as of December 31 of each year.

- Carry out the withholding of income tax when salaries or wages are paid to workers, and where appropriate, deliver in cash the amounts that result in your favor as a subsidy for employment.

- Calculate in the Annual Declaration of income tax, the participation of workers in the profits of the company (PTU).

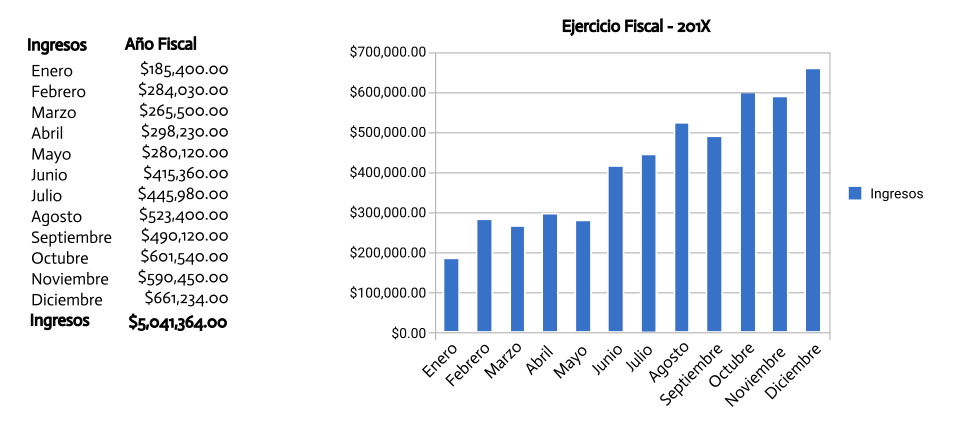

Because we are in the 5th year of the implementation of the RIF, we will address the possible migration to Business Activity by exceeding 2 million Mexican pesos during the fiscal year.

We will use a demonstrative example of the fiscal year income of a taxpayer registered in the RIF under the following tabulator,

Based on rule 3.13.9,

I. Los ingresos percibidos hasta $2’000,000.00 (dos millones de pesos 00/100 M.N.), serán declarados en el bimestre que corresponda al mes en que se rebasó la cantidad citada, calculando el ISR en términos de lo dispuesto en la Sección II del Capítulo II del Título IV de la Ley del ISR, el cual tendrá el carácter de pago definitivo.

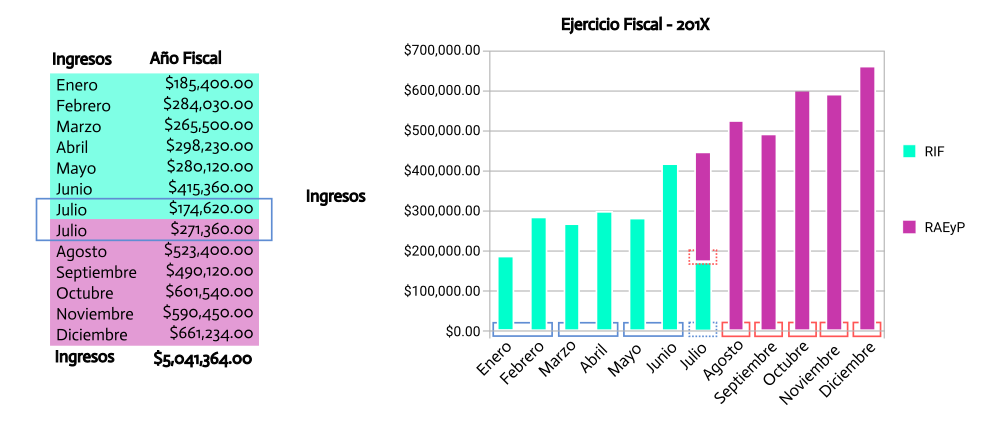

With this in mind we can now visualize the same tabulation in a different way,

In the example, we can observe that from the beginning of the year and up to the first $ 174,620.00 pesos of income in the month of July, the 2 million pesos are reached, these, said in a practical way, will be subject to the criteria of the RIF and the difference of the same month ($ 271,360.00) under the criteria of Business and Professional Activity (RAEyP), within the same year, which includes the presentation of the annual statement on the dates set for it.

In this exercise, we can note that starting in July, the statements will be monthly, as established by law in terms of the Business and Professional Activity Regime.

Is it possible to revert the change to RAEyP?

The law mentions that the reduction of obligations is inadmissible , however, we do not rule out that in case of a ruling in favor through litigation (tax defense) the authority allows the reduction to incorporation regime.

These changes undoubtedly represent a challenge in contrast to the facilities and benefits that the RIF presents, so we invite you to maintain a constant communication with your accounting team and thus have an updated image of your tax situation.

As usual, if you have any questions, we invite you to contact and schedule an appointment to deepen your specific case in a thorough way.