by Despacho Contable de Xalapa | Jan 22, 2020 | News

On December 28, 2019, the Fiscal Miscellaneous Resolution for 2020 was published in the Official Gazette of the Federation, which provides for a period of 10 days to settle bills for 2019, without making any withholding. RMF 2020 (Spanish)Download The article in...

by Despacho Contable de Xalapa | Jan 9, 2020 | News

As you know, the law requires that all suppliers of products, goods or services have the assets, personnel, infrastructure or material capacity to provide the services or produce, market goods, so that this covers the tax receipts issued and in turn , these are...

by Despacho Contable de Xalapa | Nov 20, 2019 | News

In compliance with legislative reforms against organized crime and tax evasion, we consider it important to remember the current context of the use of cash according to the LFPIORPI. The LFPIORPI, also known as the Law Against Money Laundering , stipulates in its...

by Despacho Contable de Xalapa | Sep 26, 2019 | News

Carlos Romero Aranda – PFF Holder On the occasion of the presentation of the 2020 economic package, and the recent reform approved by the Senate to the Federal Law Against Organized Crime, the National Security Law, the National Codes of Criminal Procedures,...

by Despacho Contable de Xalapa | Aug 23, 2019 | Uncategorized

An easy topic to neglect but of great importance since we find it is more common than apparent. What do we mean by mentioning localizable? All taxpayers when registering in the Federal Taxpayers Registry (RFC), are required to register the well-known “fiscal...

by Despacho Contable de Xalapa | Jun 26, 2019 | News

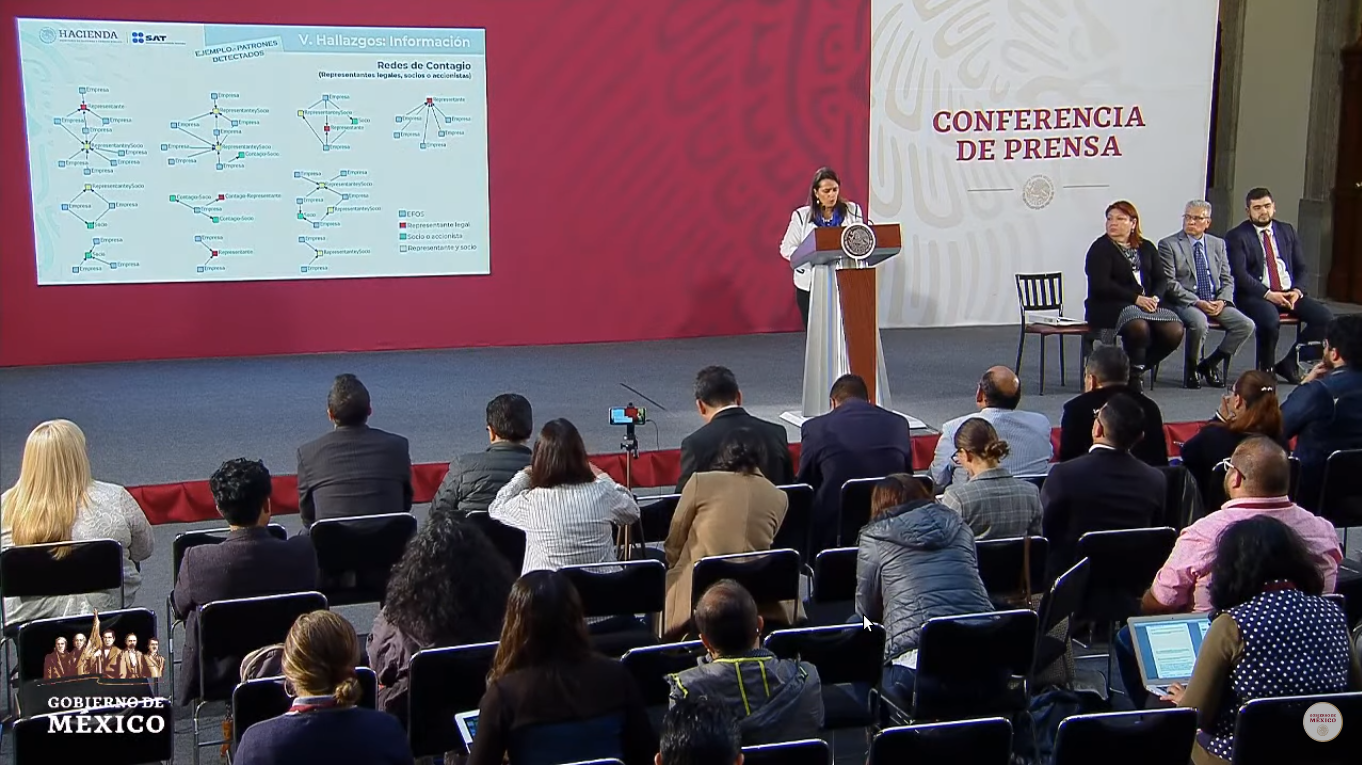

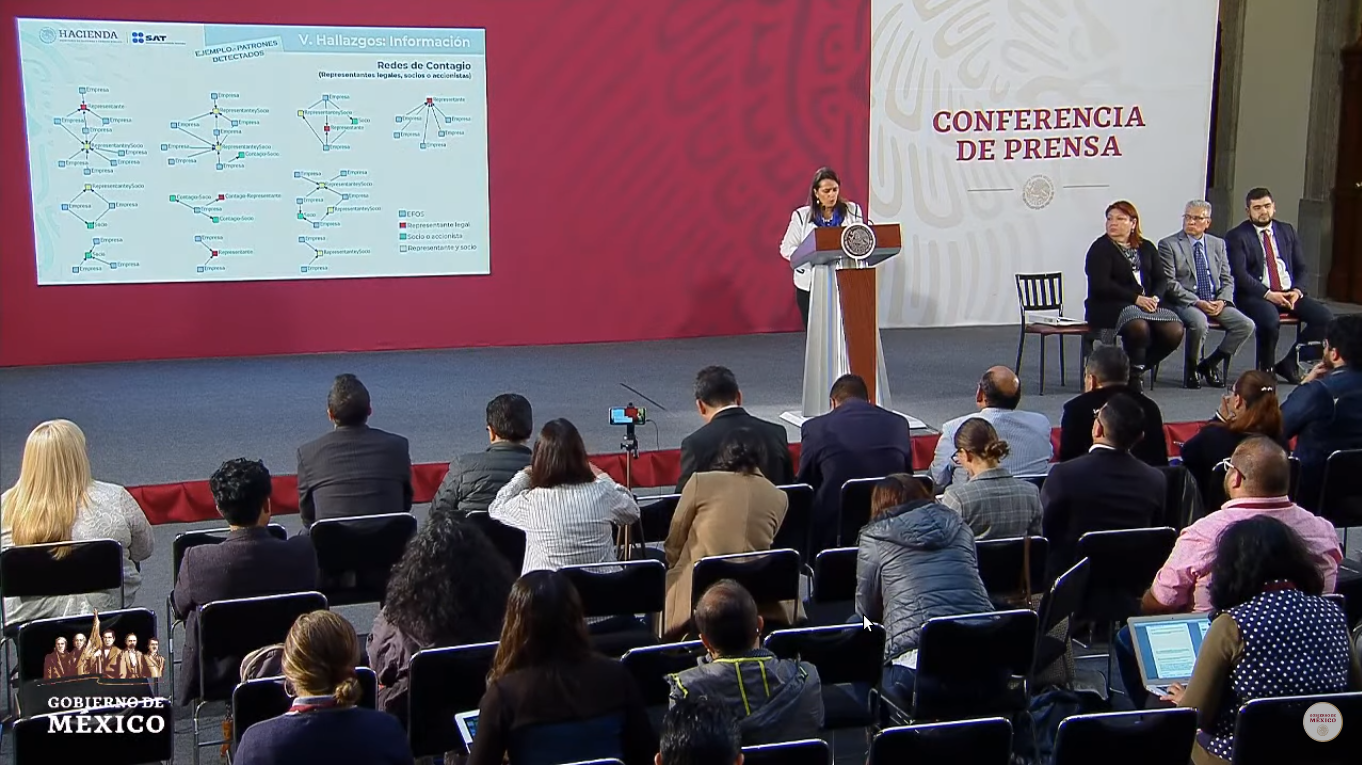

Some of the most recent tax changes, we found the increase in penalties for tax offenses , as well as the revocation of tax privileges to large taxpayers . On this occasion, on June 25, the head of the SAT, Dr. Margarita Ríos Farjat, announced that she will start a...

by Despacho Contable de Xalapa | May 30, 2019 | News

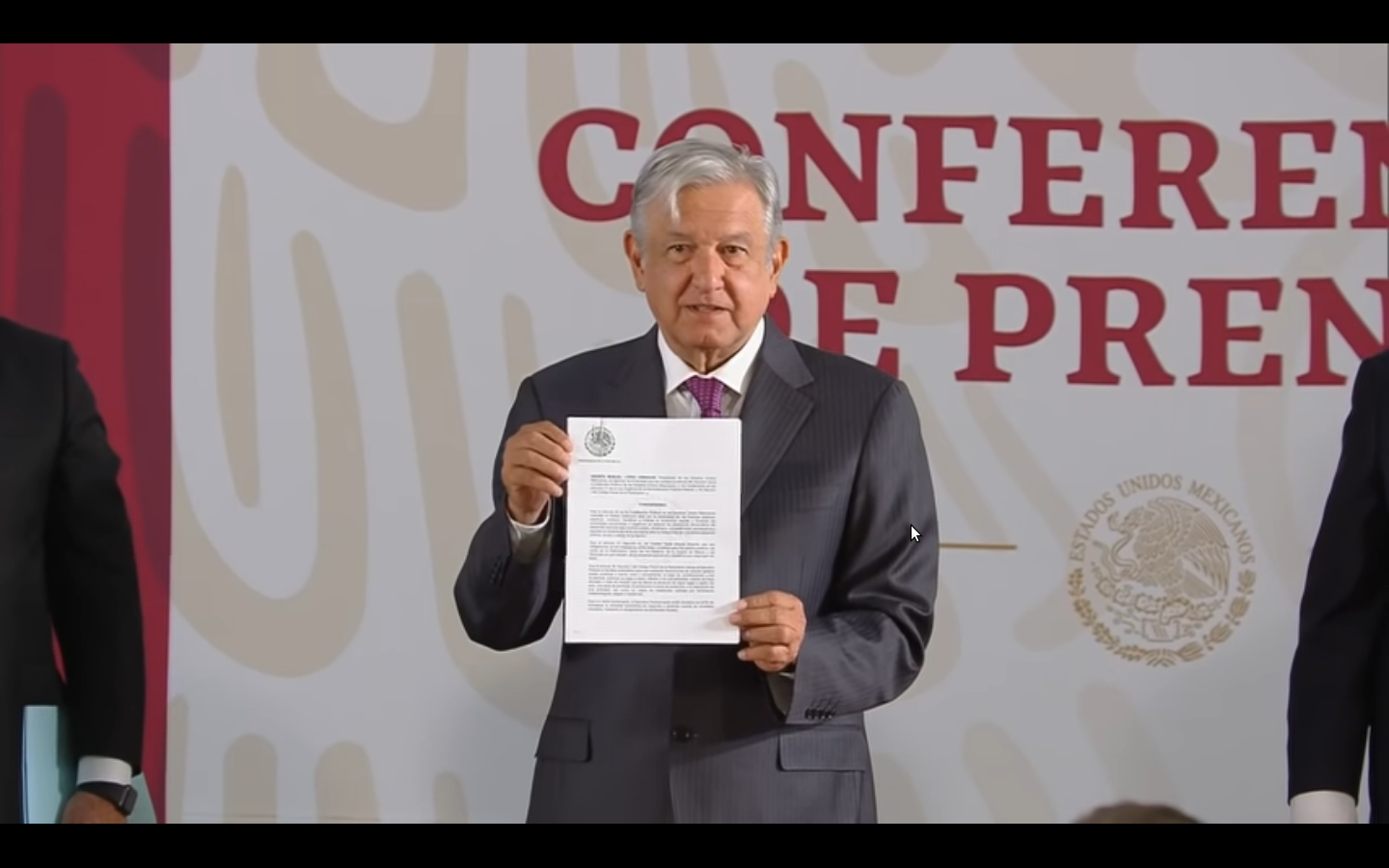

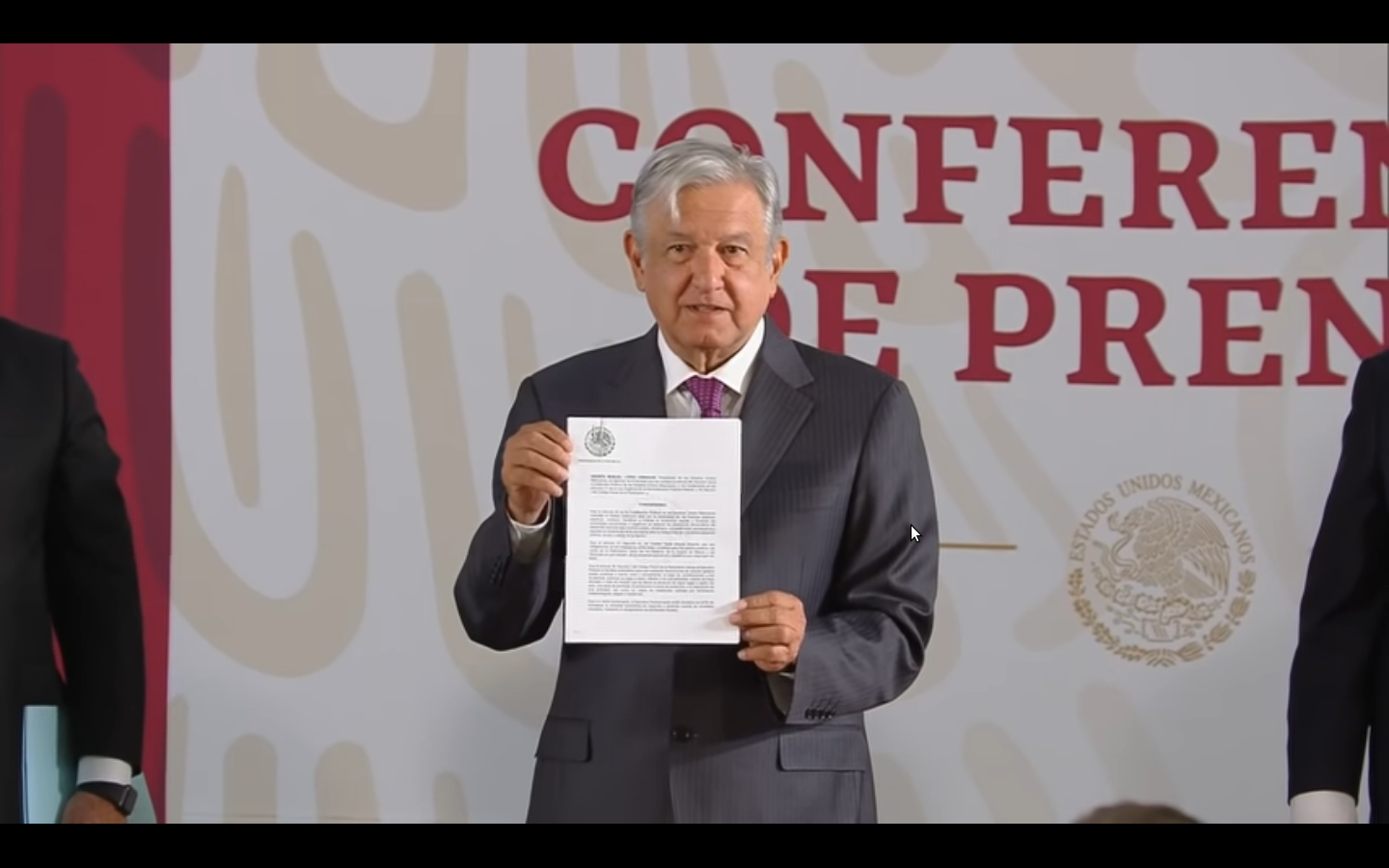

Last week, during the morning press conferences, the president signed a decree that ends with the forgiveness of taxes, a public policy that began in late 2000. 2000 – 2006 – Applying waivers of 10% to 12.5% 2007 – 2012 – Applying waivers of up...

by Despacho Contable de Xalapa | May 16, 2019 | News

Since the arrival of the new administration of President Andrés Manuel Lopéz Obrador has always said that corruption is one of the main ills that affects Mexico. As part of its anti-corruption campaign, there have been many constitutional changes that support the...

by Despacho Contable de Xalapa | Apr 2, 2019 | News

Great poets and poetesses have dedicated their greatest verses to the tangible element that governs our days: time. Fiscally, the implications of distributing our time in such and such a way represent the inclusion in two or more of the regimes of the fourth title of...

by Despacho Contable de Xalapa | Mar 25, 2019 | News

With the creation of the Fiscal Incorporation Regime, RIF in Spanish, the “small” taxpayers have been included in the national financial activity under a simple framework and with multiple tax benefits for them. However, it has 3 fundamental limitations,...