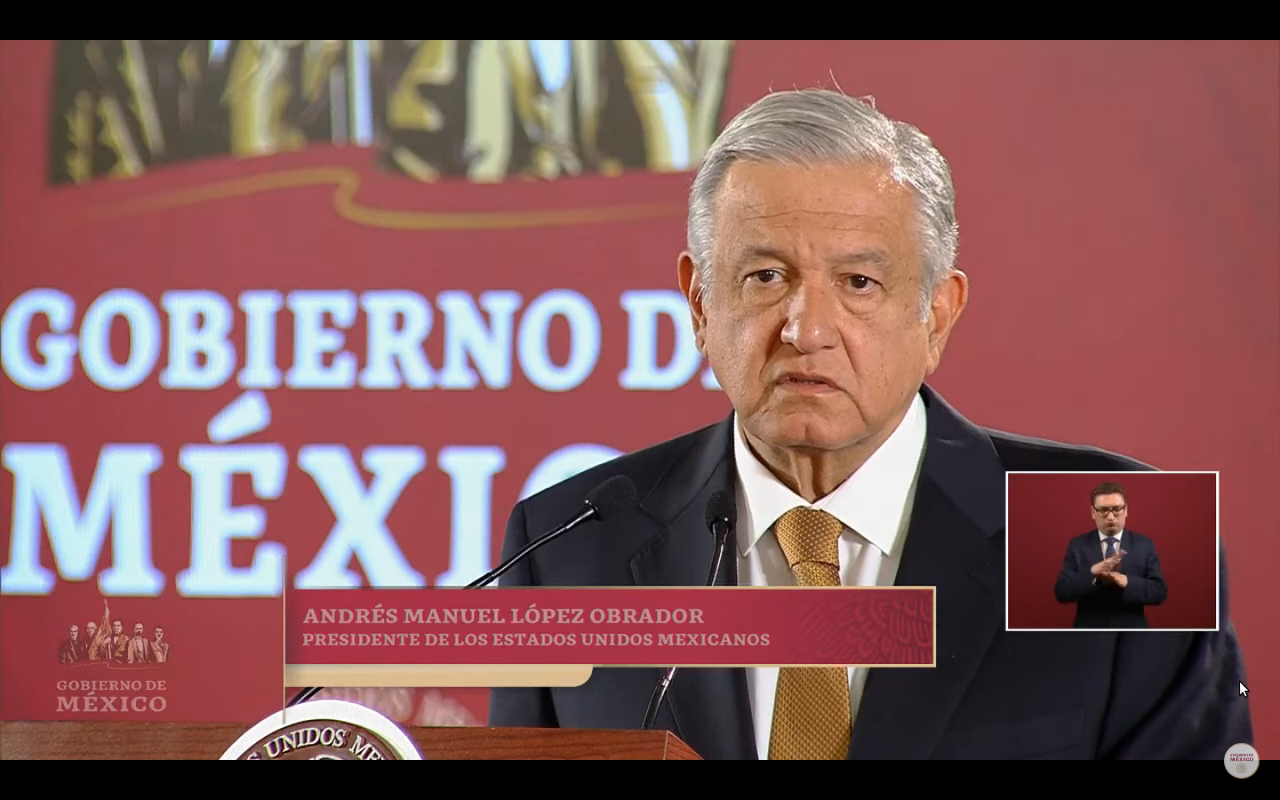

Since the arrival of the new administration of President Andrés Manuel Lopéz Obrador has always said that corruption is one of the main ills that affects Mexico.

As part of its anti-corruption campaign, there have been many constitutional changes that support the country, mainly the theft of hydrocarbons, as well as electoral crimes, now serious crimes.

Today has been published in the Official Gazette of the Federation (DOF), the following decree:

In this decree, section III of article 113 of the Fiscal Code of the Federation is modified, adding article 113 Bis which says:

Artículo 113 Bis.- Se impondrá sanción de tres a seis años de prisión, al que expida o enajene comprobantes fiscales que amparen operaciones inexistentes, falsas o actos jurídicos simulados.

Transitorios

Primero.- El presente Decreto entrará en vigor al día siguiente de su publicación en el Diario Oficial de la Federación.

DOF – Executive Order – 16/05/2019

Segundo.- Se derogan las disposiciones que se opongan al presente Decreto.

Therefore this modification increases the penalty from 3 months to 3 years in prison to those who issue or alienate tax receipts that cover non-existent, false transactions or simulated legal acts.

This movement is a clear reinforcement by the Federal Government in the policy against corruption as well as tax evasion.

We believe that a healthy accounting rests within a clear legal framework and supported by a policy of economic development , so we applaud this movement and mention it to support its dissemination as well as the legal consequences.

We invite all taxpayers to have an accounting advisor who can guide them and avoid falling into practices that may misinterpret their operations before the Treasury, maintaining a framework of legality and fiscal health to you and your economic activity.