Starting in January 2020, a new figure against fraud and tax evasion came into force, which the Federal Government has constantly promoted against simulated operations and “false” invoices.

Just as the Secretariat of the Civil Service implemented its program Citizen Alerts of Corruption in Mexico, during Ju

Third Fiscal Collaborator

In the fiscal area, this new figure and complaint system comes into operation through the so-called Third Fiscal Collaborator , which can be understood as:

“Aquella persona que no ha participado en la expedición, adquisición o enajenación de comprobantes fiscales que amparen operaciones inexistentes, pero que cuenta con información que no obre en poder de la autoridad fiscal, relativa a contribuyentes que han incurrido en tales conductas y que voluntariamente proporciona a la autoridad fiscal la información de la que pueda disponer legalmente y que sea suficiente para acreditar dicha situación”.

In this way, the treasury can receive, use verifiable information and documentation to support the corresponding procedures.

How to report?

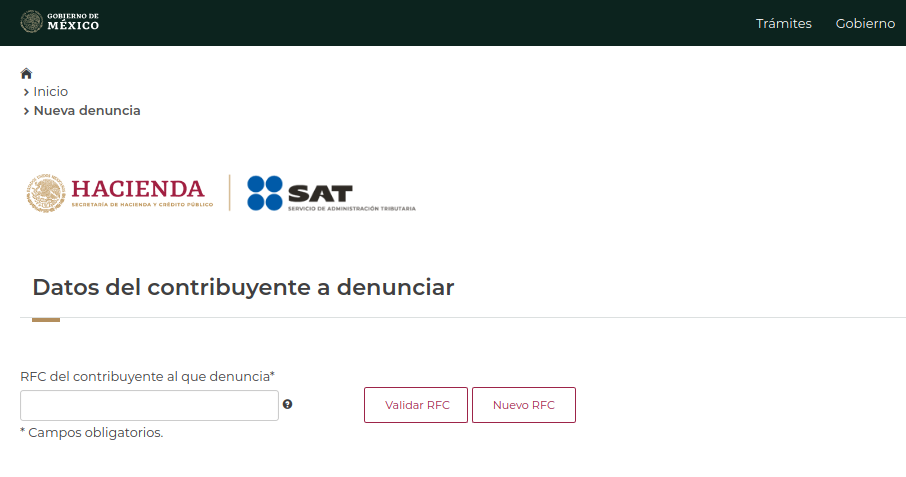

In order to file your complaint, in accordance with article 69-B Ter of the CFF and its Rule, it is necessary that you provide the following information:

- The reported taxpayer’s RFC.

- The name, reason or company name of the taxpayer reported.

- A detailed description of the facts that you report, providing the circumstances of the mode (how it happened), time (when it happened) and place (where it happened); and specifying the position that the accused occupies in relation to other taxpayers involved in the operating scheme.

- Your complete name

- Your telephone number

- Your email address

- The electronic file that contains the documentation related to the information you provide

Based on CFF Article 69-B,

“Cuando la autoridad fiscal detecte que un contribuyente ha estado emitiendo comprobantes sin contar con los activos, personal, infraestructura o capacidad material, directa o indirectamente, para prestar los servicios o producir, comercializar o entregar los bienes que amparan tales comprobantes, o bien, que dichos contribuyentes se encuentren no localizados, se presumirá la inexistencia de las operaciones amparadas en tales comprobantes”

The taxpayer will be notified through the tax mailbox, as well as by publication in the Official Gazette of the Federation, so that those taxpayers can express to the tax authority what they their right is appropriate and provide the documentation and information they consider relevant to distort the facts that led the authority to notify them.

Finally mention that there is a maximum of 5 business days from the Third Fiscal Collaborator to present the support for the complaint, otherwise it will be necessary to restart the process.

With the entry into force of the Third Fiscal Collaborator , we are witnessing the growing support by the Federal Government in the population and the culture of denouncing against activities with high impact on society and public finances, corruption as well as evasion and fraud.

We have previously commented,

We consider that the best long and medium-term strategy is to comply with the obligations and in accordance with the law, in a fair way, so that their tax burden is not seen increased by additional costs such as fines and surcharge